The Management Board of Krka, d. d., Novo mesto held a press conference today and presented the 2021 unaudited performance estimate for the Krka Group, which the Supervisory Board discussed at their meeting yesterday. The Krka Group generated €1,565.8 million revenue, up 2% on 2020. According to unaudited financial statement estimates, net profit of the Krka Group totalled €304.7 million, up 5% on 2020. Publication of the 2021 unaudited financial statements of the Krka Group and Krka, d. d. is scheduled for Thursday, 17 March 2022.

The President of the Management Board and Chief Executive Jože Colarič explained: ‘Last year was quite challenging, but the Krka Group performed successfully and in accordance with expectations. We proved once again that thanks to our vertically integrated business model we are flexible and ready to react instantly to opportunities and challenges in our markets. We recorded the strongest sales since incorporation totalling €1,565.8 million. The value and volume sales growth was 2%. We maintain high profitability of operations and expect to generate net profit in excess of €304 million. We were granted marketing authorisations for 16 new products, of them 14 prescription pharmaceuticals and two animal health products. We also brought to the end more than 200 registration procedures, and obtained more than 1,000 marketing authorisations for various products. It pleases me that thanks to good business performance shareholders place trust in us, which is reflected in the growing Krka share price. Last year, the Krka share price on the Ljubljana Stock Exchange went up by a good 29%.

Thanks to our resolute actions and consistent implementation of preventive measures, including arrangements for vaccination of our employees, business operations ran smoothly also during the COVID-19 pandemic. Production and supply of our finished products were uninterrupted.

We manufacture active ingredients, which we incorporate into products, in-house or buy them in the market.

The number of raw material manufacturers in the markets kept falling for ecological and financial reasons, and due to reasons related to good manufacturing practice. We managed to secure sufficient quantities of raw materials at competitive prices despite the unstable situation, shortage of incoming materials, lower manufacturing output at our partners’, and complicated logistics.

The Supervisory Board reappointed the Management Board under my leadership for another term, ending at the end of 2027. Based on the expressed trust, my colleagues and I will continue to pursue the set company goals together. We upgraded them in the five-year strategy reviewed last year. Also in the future, Krka will remain an internationally established and innovative generic pharmaceutical company that achieves the set financial and sustainable goals to the benefit all stakeholders.’

Key Financial Estimates

| € thousand | Krka Group | ||

| Estimated 2021 | Realised 2020 | Change | |

| Revenue | 1,565,802 | 1,534,941 | 2% |

| – Of that revenue from contracts with customers (products and services) | 1,560,288 | 1,529,959 | 2% |

| EBITDA | 461,904 | 502,432 | -8% |

| EBIT | 352,948 | 390,744 | -10% |

| EBT | 360,170 | 338,992 | 6% |

| Net profit | 304,679 | 288,949 | 5% |

| Earnings per share (€) | 9.77 | 9.27 | 5% |

| RATIOS | |||

| EBITDA margin | 29.5% | 32.7% | |

| EBIT margin | 22.5% | 25.5% | |

| EBT margin | 23.0% | 22.1% | |

| Net profit margin | 19.5% | 18.8% | |

Sales

In 2021, the Krka Group generated €1,565.8 million revenue, of which revenue from contracts with customers on sales of products and services amounted to €1,560.3 million. Revenue from contracts with customers on sales of materials and other sales revenue constituted the difference. Revenue was by €30.9 million or 2% higher than the year before.

Sales of Products and Services by Region

| Krka Group | |||

| € thousand | 2021 | 2020 | Index |

| Region Slovenia | 92,880 | 85,138 | 109 |

| Region South-East Europe | 209,166 | 199,406 | 105 |

| Region East Europe | 547,778 | 517,231 | 106 |

| Region Central Europe | 351,501 | 341,463 | 103 |

| Region West Europe | 305,246 | 341,057 | 89 |

| Region Overseas Markets | 53,717 | 45,664 | 118 |

| Total | 1,560,288 | 1,529,959 | 102 |

All sales regions recorded sales growth, except Region West Europe. We increased our sales volume by a good 2%, producing more than 16 billion of tablets, capsules and bottles of syrups.

Region East Europe generated €547.8 million, or 35.1% of Krka Group’s sales total, and was the largest region in terms of sales. Sales increased by 6% year on year. In the Russian Federation, we made €332.9 million by product sales, a 2% rise on 2020. Sales growth denominated in the Russian rouble reached 9%. In Ukraine, product sales reached €96.4 million, up 12%. We also recorded growth in all other regional markets, except in Armenia and Tajikistan.

Region Central Europe, comprising the Visegrad Group and the Baltic states, followed with €351.5 million, or 22.5% of total Krka Group sales. We recorded 3% growth compared to the year before. Poland, the leading market, generated product sales of €166.7 million and recorded 2% growth. Sales growth denominated in the zloty reached 5%. Sales grew in all countries of the region. Absolute growth was the highest in Poland, and relative in Latvia.

Region West Europe made €305.2 million accounting for a 19.6% share, and was the third largest Krka Group region in terms of sales. The sales saw an 11% drop on the year before, primarily due to price pressure and fewer product launches. We generated the strongest sales in Germany, the Scandinavian countries, France, Italy, and Portugal, and recorded the highest growth rates in Ireland, the United Kingdom, and Austria.

Product sales in Region South-East Europe amounted to €209.2 million, 5% more than in 2020, and constituted 13.4% of total Krka Group sales. Romania and Croatia remained the two leading regional markets. We recorded the highest relative sales growth in North Macedonia, Serbia, and Bulgaria.

In Slovenia, sales reached €92.9 million, accounting for 6% of total Krka Group sales. Sales grew by 9%. Products sales constituted the bulk of €56.4 million sales total, reaching 2% growth. Health resorts and tourist services yielded €36.5 million, a 23% rise on 2020.

Region Overseas Markets accounted for a 3.4% share of total Krka Group sales and yielded €53.7 million in product sales, an 18% year-on-year climb. We achieved sales growth in most markets of the region.

Sales of Products and Services by Group

| Krka Group | |||

| € thousand | 2021 | 2020 | Index |

| Human health | 1,442,566 | 1,424,292 | 101 |

| – Prescription pharmaceuticals | 1,305,316 | 1,300,640 | 100 |

| – Non-prescription products | 137,250 | 123,652 | 111 |

| Animal health products | 81,257 | 75,913 | 107 |

| Health resorts and tourist services | 36,465 | 29,754 | 123 |

| Total | 1,560,288 | 1,529,959 | 102 |

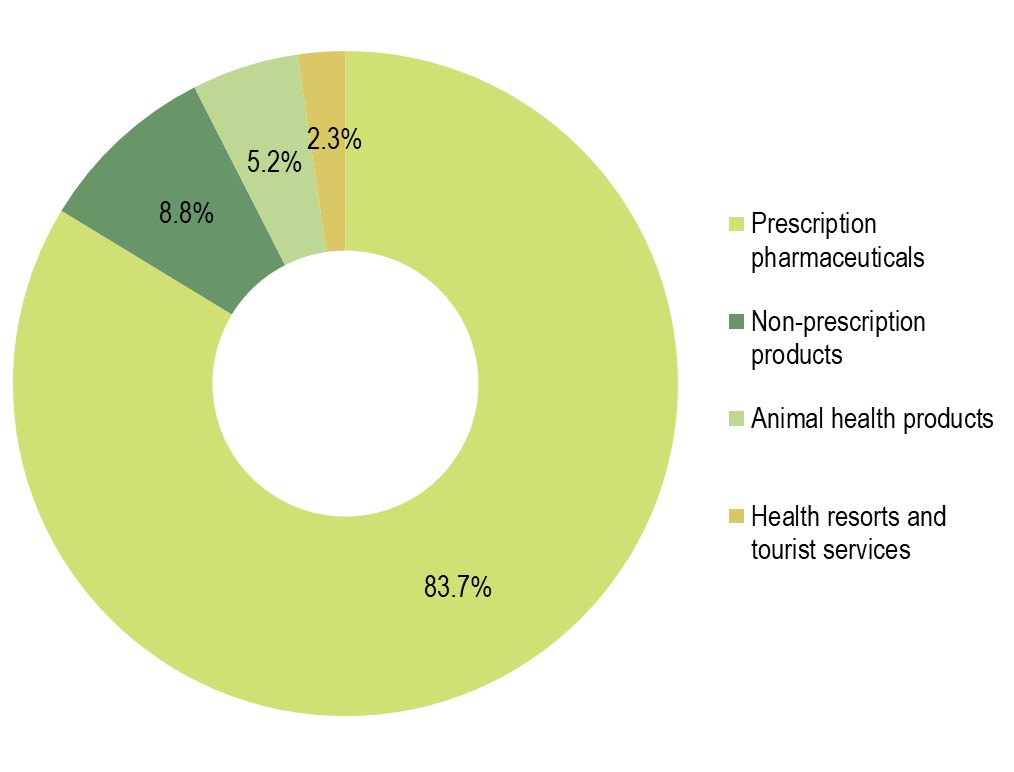

The Krka Group sales of prescription pharmaceuticals totalled €1,305.3 million, up 0.4% on 2020, accounting for 83.7% of total product and service sales. Sales increases were recorded in all regions, except Region West Europe, ranging as follows:

-

- 21% Region Overseas Markets;

- 6% Region South-East Europe;

- 4% Region East Europe;

- 4% Region Central Europe; and

- 2% Region Slovenia.

Of our ten largest individual markets, relative sales growth of prescription pharmaceuticals was the highest in Ukraine, the Czech Republic, and Slovakia; and of our other markets in the Middle East, Mongolia, Uzbekistan, and Belarus. Top-ranking prescription pharmaceuticals remained medicines for treating cardiovascular diseases, the central nervous system, and gastrointestinal tract.

Ten leading prescription pharmaceuticals in terms of sales were product groups containing:

-

- valsartan (Valsacor, Valsacombi, Vamloset, Co-Vamloset, Valarox);

- perindopril (Prenessa, Co-Prenessa, Amlessa, Co-Amlessa, Roxiper, Roxampex);

- losartan (Lorista, Lorista H, Lorista HD, Tenloris);

- atorvastatin (Atoris);

- pantoprazole (Nolpaza);

- rosuvastatin (Roswera, Co-Roswera);

- esomeprazole (Emanera);

- enalapril (Enap, Enap H, Enap HL, Elernap);

- candesartan (Karbis, Karbicombi, Kandoset); and

- tramadol (Doreta, Tadol).

All pharmaceuticals listed above are marketed under different brand names in individual countries.

Sales of non-prescription products totalled €137.3 million, up 11% on 2020, accounting for 8.8% of total sales. Sales of animal health products grew by 7% to €81.3 million (5.2% of total sales). Sales of health resorts and tourist services totalled €36.5 million, up 23% on 2020 (2.3% of total sales).

Research and Development

We were granted marketing authorisations for 16 new products, of that 14 prescription pharmaceuticals, and two animal health products. We brought to the end more than 200 registration procedures, obtaining more than 1,000 marketing authorisations for various products.

We obtained marketing authorisations for several prescription pharmaceuticals:

- Agents containing new active ingredients, i.e. the antithrombotic agent Aboxoma (apixaban) in film-coated tablets, also marketed as Abidalo; two oncology agents Abiraterone Krka (abiraterone) in film-coated tablets and Sunitinib Krka (sunitinib) in hard capsules; and an opioid analgesic Apeneta (tapentadol) in prolonged-release tablets, marketed also as Adoben;

- Our new single-pill combination for the treatment of diabetes, Vimetso (vildagliptin/metformin) film-coated tablets, marketed also as Vildakombi;

- Two cardiovascular agents based on a new perindopril salt, i.e. single-agent tablets Prenessa (perindopril arginine), in markets also available as Prenessa Neo, Prenessa As, Neoprenessa, Arprenessa, or Perineva; and a single-pill combination of perindopril arginine and indapamide, Neoprenewel tablets, in markets also available as Prenewel Neo, Co-Prenessa, Co-Prenessa Neo, Prenessa-As, Coarprenessa, or Co-Perineva;

- Two established active ingredients in a new pharmaceutical form, i.e. orodispersible tablets, the analgesic Doreta (tramadol/paracetamol) and antibiotic Hiconcil (amoxicillin);

- Cardiovascular agents containing atorvastatin, rosuvastatin and losartan in China; and the oncology medicine lenalidomide in the Russian Federation; and carried out new market-based studies for them;

- The agent for reducing high cholesterol levels Ezoleta (ezetimibe) based on our own optimised active ingredient.We continuously upgrade, improve, and bring our established products in line with the latest trends and requirements, then file marketing authorisation applications for regulatory variations with regulatory authorities for our revised products. In 2021, we applied for more than 36,000 variations for products optimisation.We filed 42 applications for Krka trademarks in Slovenia. We also filed 29 international and 27 national trademark applications. More than 1,100 trademarks are registered in several countries.

- Last year, we filed 12 patent applications for new technological solutions evaluated as inventions at the global ranking level. Based on priority applications from 2020, we submitted four international patent applications. We were granted three patent rights in several countries. More than 200 valid patents protected our technological solutions.

- We added a single-pill combination Cladaxxa (amoxicillin/clavulanic acid), marketed also as Twinox, from our antibiotic range to our animal health portfolio, and a new formulation of the single-pill combination Milprazon (milbemycin/praziquantel) antiparasitic tablets for dogs, also marketed as Amcofen, Mektix, or Milgusto.

Investments

The estimated value of investments in 2021 reached €66 million, of that €49 million in the controlling company. They were primarily made to increase and technologically upgrade production, development and quality management capacities. We also invested in our own production and distribution centres around the world.

Our state-of-the-art facility for manufacturing solid dosage forms, the Notol 2 Plant in Ločna, Novo mesto, Slovenia, has been in operation for several years. The growing need for production capacities has incited us to acquire additional technological equipment for the plant. The investment was estimated at €41 million. In 2021, we allocated €8.5 million for it. When technologically equipped, the full manufacturing capacity of the plant will reach 5 billion tablets, and 8 billion packagings per year.

At the old Notol Plant, we intend to upgrade and renew automated washing systems in compliance with cGMP guidelines. We are also drawing up the project design for water systems estimated at €3.1 million. We plan to refurbish the packaging facility and upgrade packaging lines at the same plant. The investment was estimated at €38.2 million.

We are investing €26 million in additional capacities for compression mixture preparation and granulation in the tablet pressing process at the Solid Dosage Form Production Plant, and in logistic capacities.

We are bringing to the end several investments in our development-and-research facilities in total of €8.2 million.

In the warehousing section of the manufacturing plant in Ljutomer, Slovenia, a temporary storage room was refurbished in compliance with the standards of good warehousing practice and health and safety at work. We apportioned €2 million to the investment. Also in Ljutomer, we started increasing production capacities for granulation and packaging, estimated at €13 million.

In Beta Plant in Šentjernej, Slovenia, we have already upgraded the systems and equipment at the plant in compliance with ATEX standards, and plan to increase the production capacity for preparation of dry granules as well. Total value of the investment was estimated at €2.6 million.

We plan to construct a new multi-purpose building called Paviljon 3 in Novo mesto. It will house an extension for our microbiology laboratory and additional rooms for several organisational units. Project documentation for the investment worth €18.6 million has been completed, and construction works are expected to start in March.

As our production capacities increase, so does the demand for energy. We are currently financing larger production capacities for compressed air and new utility lines for energy supply to manufacturing facilities. The investment in energy infrastructure extension at our Novo mesto production facility is estimated at €2.5 million.

We plan to build new facilities for development and production of active pharmaceutical ingredients (APIs) in Krško, Slovenia. The designs for execution have been drawn up and the process of obtaining the required consent to build the Sinteza 2 Plant for manufacturing active pharmaceutical ingredients and laboratories for chemical analyses are under way. We also plan to build other small technological facilities and infrastructure required for an uninterrupted production process. The investment worth €163 million agrees with our strategy of vertical integration, according to which Krka controls all product stages, from product development to its production.

The Krka-Rus plant north-west from Moscow in the industrial zone of Istra is one of the key investments in Krka subsidiaries abroad. The plant manufactures more than 75% of products intended for the Russian market, giving us the status of a domestic producer in the Russian Federation. In the next few years, we plan to further increase its production and laboratory capacities. The investment is estimated at €35 million. In 2021, we allocated €5.7 million for it.

We continue to purchase manufacturing and quality control equipment for our joint venture Ningbo Krka Menovo in China. The joint venture manufactures products for markets outside China, and since January 2021, also the first product intended for the Chinese market. Manufacture of another three products starts in the first quarter of 2022.

Employees

At the end of 2021, the Krka Group employed 11,511 persons of whom 46% or 5,273 worked outside Slovenia.

The proportion of Krka Group employees with at least university-level qualifications was 51%, of whom 207 employees held doctoral degrees. Together with agency workers, the Krka Group employed 12,459 personnel.

Share and Investor Information

In 2021, the price of Krka share on the Ljubljana Stock Exchange increased by a good 29%, reaching €118.00 at the end of the year. Market capitalisation of Krka amounted to €3.9 billion.

At the end of the year, Krka had 46,820 shareholders, down 1% on the end of 2020. The shareholding structure, with 38.8% of domestic retail investors (natural persons) and 22.2% of foreign investors, is stable and without any major changes.

In 2021, we allocated €15.3 million to treasury share purchasing and €156 million to dividend payouts. We acquired 142,134 treasury shares, and as at 31 December 2021 held a total of 1,683,908 treasury shares, accounting for 5.135% of share capital.

Sustainability (ESG)

In the project of upgrading the sustainability (ESG) governance of the Krka Group, we specified the material sustainability topics, which are important to the Krka Group and our key stakeholders. Addressing the ESG topics properly allows the Krka Group to achieve the objectives and implement the business strategy in the long run. In the process, we identified environmental, social, governance, and economic ESG topics, also with engagement of our stakeholders. At their December 2021 meeting, the Management Board confirmed the ESG topics as follows: (i) Product quality and patient safety; (ii) Talent attraction and retention; (iii) Accessible healthcare; (iv) Good leadership and governance practices; (v) Compliance, integrity, and transparency; (vi) Planet and climate change; and (vii) Economic impacts and taxes. We are fully aware of the importance of sustainable development and our sustainability impact. We intend to focus on sustainability even more closely in the future.

2022 Krka Group Plans

The 2022 Krka Group plans product and service sales at €1.610 million and net profit at approximately €300 million. We intend to allocate €130 million for expansion and technological upgrades of production and development capacities and the infrastructure. We plan to increase the total number of employees in Slovenia and abroad by 2%.

The 2022 Krka Group Business Plan is in conformity with the updated 2022–2026 Development Strategy of the Krka Group, which was adopted by the Management Board at their November meeting and presented to the Supervisory Board. It is based on expectations, estimates, forecasts, and other available data. The Management Board believe the projections are reasonable.