Novo mesto, 19 March 2020 – Today, the 2019 unaudited performance results of the Krka Group and the Company were published on the website of the Ljubljana Stock Exchange. The Company Supervisory Board discussed the results at their meeting yesterday. The Krka Group generated sales of €1,493.4 million, up 12% compared to 2018, and reached the highest sales value to date. Unaudited net profit of the Krka Group totalled €244.3 million, a €70.3 million or 40% rise over 2018, also hitting a historic high. Last year’s business performance shows that the Krka Group strategy with the vertically integrated business model and a wide range of safe, effective, quality, and deliverable products has been well planned. The 2019 annual report scheduled to be published on Thursday, 16 April 2020.

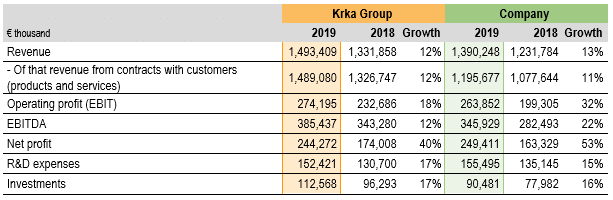

Financial Highlights

Performance Ratios

In 2019, all financial highlights and performance ratios of the Krka Group and the Company indicated in the tables above have improved compared to 2018.

Sales

The Krka Group generated revenue in total of €1,493.4 million, of which revenue from contracts with customers on sales of products and services amounted to €1,489.1 million, while revenue from contracts with customers on sales of material and other sales revenue constituted the difference.

In 2019, the Krka Group revenue from contracts with customers on sales of products and services added up to €1,489.1 million, an increase of €162.3 million or 12% over 2018. All sales regions and the majority of markets recorded sales growth. We increased sales of all product and service groups.

Krka Group Sales of Products and Services by Region

Generating €481.2 million and a 17% rise over total sales in 2018, the largest region of the Krka Group in terms of sales was Region East Europe. In the Russian Federation, we made €310.5 million by product sales, a 13% increase compared to 2018. Sales growth dynamics in the Russian Federation has been above the average for several years now. In 2019, we achieved sales value of €79.8 million and 42% growth in Ukraine, which was significantly higher than the market growth. In Uzbekistan, product sales amounted to €22.5 million, up 18% over 2018. This earned us a place among the most important providers of medicines in the country, especially of medicines for the treatment of cardiovascular diseases. We also recorded double-digit sales growth in terms of value in Turkmenistan (30%), Kyrgyzstan (24%), Belarus (21%), Tajikistan (21%), Armenia (13%), and Moldova (13%).

Region Central Europe, comprising the Visegrad Group and the Baltic states, followed with sales at €339.6 million. Year-on-year, we reached 7% growth. In Poland, the key and largest regional market, product sales totalled €159.5 million, 7% more than in 2018. We recorded the highest growth rates of all foreign providers of generic medicines in the country and took the fourth place. Hungary, another key market, recorded 9% sales growth, reaching €51.6 million. This placed us second among primarily foreign providers of generic medicines. In the Czech Republic, also one of our key markets, sales lagged slightly behind the 2018 figure and amounted to €46.4 million. Sales growth was also recorded in Lithuania (23%), Estonia (18%), Slovakia (8%), and Latvia (5%).

In terms of Krka Group sales value, Region West Europe placed third with €336.1 million and a 17% increase over 2018. Germany, the Scandinavian countries, Spain, and Italy generated the strongest sales. Sales through subsidiaries were essential for continued sales growth and accounted for 76% of the regional sales, while sales through unrelated parties retained the 2018 level. In Germany, our most important market of West Europe, we recorded sales total of €85.4 million, an 18% climb over 2018. In Scandinavia, the second largest market in the region, sales saw a 67% increase and totalled €54.0 million. Double-digit market growth was also reached in Finland (68%), Benelux (27 %), Portugal (11%), and Italy (10%).

Sales of products in Region South-East Europe amounted to €191.3 million, a 9% rise over the year before. In Romania, our key and largest regional market, sales amounted to €56.4 million, a 6% year-on-year increase. In Croatia, also one of Krka’s key markets, our product sales generated €35.5 million. We recorded 6% growth and consolidated the fourth place among all manufacturers of generic medicines and second place among the manufacturers of medicines for veterinary use. Sales increased in all markets of the region except in Albania.

Sales of products and services in Slovenia totalled €92.4 million, of which health resorts and tourist services amounted to €39.5 million. The value of product sales was up 3%.

Region Overseas Markets generated €48.6 million in product sales and retained 12% growth. Individual markets of the Middle East, the Far East, and Africa, in particular Iran and Vietnam, contributed the most to total regional sales.

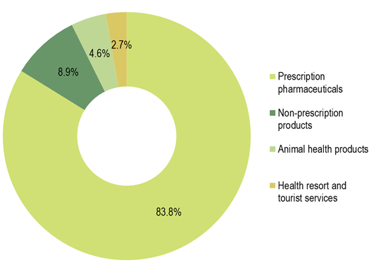

Krka Group Sales by Product and Service Groups

In 2019, the Krka Group sales of prescription pharmaceuticals amounted to €1,247.3 million, a 13% year-on-year upsurge.

As far as sales of prescription pharmaceuticals are concerned, medicines for the treatment of cardiovascular diseases remained the key therapeutic group in 2019, followed by medicines for the treatment of the central nervous system, and medicines for the gastrointestinal tract.

In 2019, sales of new products, i.e. products launched in individual markets in the past five years, accounted for 33% of the Krka Group overall sales or 4 percentage points more than the year before.

The following new products were most important as regards sales growth in absolute terms: Darunasta (darunavir), Valtricom (valsartan/amlodipine/hydrochlorothiazide), and Parnido (paliperidone) that were put on the market in 2018, and Ezesimin (simvastatin/ezetimibe) presented in 2019. Among products presenting highest sales growth were those containing the combination of benzydamine and cetylpyridinium chloride, sold under the Septolete Total brand that we started marketing in 2015. In the same year, we began promoting Dulsevia (duloxetine) and Bravadin (ivabradine). Together with Septolete Total, they topped the list of best-selling new products of Krka in 2019.

Ten leading prescription pharmaceuticals in terms of sales were product groups containing valsartan, perindopril, losartan, atorvastatin, pantoprazole, rosuvastatin, esomeprazole, enalapril, clopidogrel, and candesartan. Combination medicines that incorporate these active ingredients are also included.

In 2019, the Krka Group sales of non-prescription products totalled €133.3 million, an 8% year-on-year increase, constituting an 8.9% share of total sales. Ukraine, the Russian Federation, and Uzbekistan contributed the most to sales growth. Our most important non-prescription product brands in terms of sales were Septolete, Herbion, Nalgesin, and Bilobil.

Sales of animal health products amounted to €69.1 million, up 9% over 2018, and accounted for a 4.6% share of total sales. Sales generated in the Russian Federation, the United Kingdom, and Germany provided the biggest sales growth contribution. Products for companion animals, such as the combination of milbemycin and praziquantel (Milprazon), were our most important animal health products in terms of sales in 2019. These were followed by products containing fipronil (Fypryst, Fypryst Combo), florfenicol (Floron), and enrofloxacin (Enroxil), and products combining pyrantel and praziquantel (Dehinel, Dehinel Plus).

Sales of health resorts and tourist services increased by 5% to €39.5 million in 2019, accounting for a 2.7% share of overall Krka Group sales.

Products may be marketed under different brand names or the Krka trademark in individual markets.

Research and Development

In 2019, we filed nine patent applications for technological solutions that we had developed and evaluated as inventions. Based on priority applications from 2018, we submitted five international patent applications. We were granted eight patents in various countries. More than 200 patents filed by Krka are currently in force.

We submitted 62 applications for Krka trademarks in Slovenia and 38 international and 18 national trademark applications. Overall, we have more than 1,100 trademarks registered in several countries.

We were granted marketing authorisations for 20 new products (13 prescription pharmaceuticals, three non-prescription products, and four animal health products) in 43 pharmaceutical forms and strengths.

We obtained marketing authorisations for our prescription pharmaceuticals as follows:

- Rosamera or Roxampex (perindopril/amlodipine/rosuvastatin) single-pill combination;

- Nebileta or Nebivolol Krka (nebivolol);

- Dasatilen or Dasatinib Krka (dasatinib);

- Atazanavir Krka (atazanavir);

- Tadusto or Twinpros or Dutamyz (dutasteride/tamsulosin);

- Sidarso or Silbesan (silodosin);

- Cinacabet (cinacalcet);

- Paracetamol Krka 1000;

- Pitavastatin Krka (pitavastatin);

- Maysiglu or Sitagavia (sitagliptin);

- a new strength of Camlor or Kandoset or Camdero (candesartan/amlodipine);

- a solution for injection or infusion Metamizol Krka (metamizole); and

- a new formulation of Dexeto or Deksametazon Krka (dexamethasone) solution for injection.

We were granted marketing authorisations for the following non-prescription products:

- Vitamin D3 Krka (cholecalciferol);

- Herbion Ivy (ivy leaf dry extract) lozenges; and

- KontrDiar (nifuroxazide).

Among animal health products, we obtained marketing authorisations for:

- Awazom (amoxicillin);

- Milprazon Chewable or Milpragold or Aderexa or Amcofen Sabor or Milprazon Plus or Mektix or Milgusto Chewable (milbemycin/praziquantel) for cats; and

- Prinocate or Imoxicate (imidacloprid/moxidectin) for cats and dogs.

Investments

The value of Krka Group investments in 2019 was €112.6 million, of that €90.5 million in the controlling company. We primarily invested in the increase and technological upgrade of our manufacturing and development capacities, in quality assurance, and in Krka owned production-and-distribution centres around the world. All projects comply with environmental standards and take into consideration direct and indirect environmental impacts. The approved equipment corresponds to the best available technology as regards environmental protection and energy efficiency, and guarantees safe and efficient operations. The largest investments in 2019 included construction of a €55.6 million product development and quality control facility Razvojno-kontrolni center 4 (RKC 4); building of a €36 million worth multipurpose warehouse; equipment of seven additional packaging lines in the Notol 2 plant totalling €18 milllion; and expansion of manufacturing and laboratory capacities in the Krka-Rus plant in the Russian Federation.

Employees

At the end of 2019, the Krka Group had 11,696 employees, of that 5,699 abroad, accounting for just short of 49% of total headcount. The proportion of Krka Group employees with at least university-level qualifications was 52%. This includes 198 employees with a doctoral degree. Together with agency workers, the Krka Group had 12,770 persons on payroll, 288 more than at the end of 2018.

Investor and Share Information

In 2019, the price of Krka share on the Ljubljana Stock Exchange increased by just shy of 27%, reaching €73.20 at the end of the year. Market capitalisation of the Company amounted to €2.4 billion.

At the end of 2019, Krka had a total of 48,631 shareholders. The shareholders’ structure, with 38.5% of individual Slovenian retail investors and 23.0% of international investors, is stable and without any major changes.

In 2019, Krka acquired 340,805 treasury shares. On 31 December 2019, Krka held 1,234,252 treasury shares, accounting for 3.764% of the share capital.

In 2020, Krka acquired further 64,220 treasury shares and now holds 1,298,472 treasury shares or 3.960% of the share capital.

Impact of SARS-CoV-2 (Coronavirus) on Business Performance

We have been carefully monitoring the epidemiological situation and new developments in China and elsewhere around the world since the coronavirus outbreak. At the beginning of 2020, even before it spread, we secured sufficient supplies of raw materials and thus made sure that our processes have been uninterrupted as far as possible. In order to prepare for the current situation, we have also taken preventive sanitary, health, and organisational measures to provide suitable conditions for reducing the risk of employee infections and enable business operations without major disruptions.

Following the declaration of a national epidemic and other government actions, the Management Board of the Company adopted additional measures to contain the spread of the coronavirus with the aim to further protect the health of all employees and consequently ensure uninterrupted business operations. This is the primary objective of medicine manufacturers such as Krka, as it is the only way to make sure there is no supply chain disruption or lack of necessary medicines on the global markets while we fight the coronavirus. Krka is a member of the European generics medicines association Medicines for Europe, which also issued a statement calling for implementation of various measures to make sure the production facilities operate without interruption.

The Management Board of the Company carefully monitor new developments in the countries where the Krka Group is present. Through development, quality control, well-organised supply chain, numerous own production facilities, marketing-and-sales activities, and support services, the vertically integrated business model of Krka covers a wide range of processes and activities at the global level. The developments with regard to the spread of the infection, its consequences, and the related measures taken by counties are fast and unpredictable. Currently, the Krka Group does not record any negative impact of the coronavirus on its business operations.