The five-year Krka Group Development Strategy serves as the blueprint for the business opportunities we pursue. The achievement of strategic objectives is measured at three levels: the Krka Group, product and service groups, and business functions.

The 2022-2026 Krka Group Development Strategy was proposed by the Management Board and approved by the Supervisory Board in November 2021. It includes all areas of operation across the Krka Group, focusing on the core pharmaceutical and chemical activity. The Strategy is updated every two years.

WE ARE MOVING FORWARD WITH A CLEAR STRATEGY, NEW PRODUCTS AND NEW MARKETS

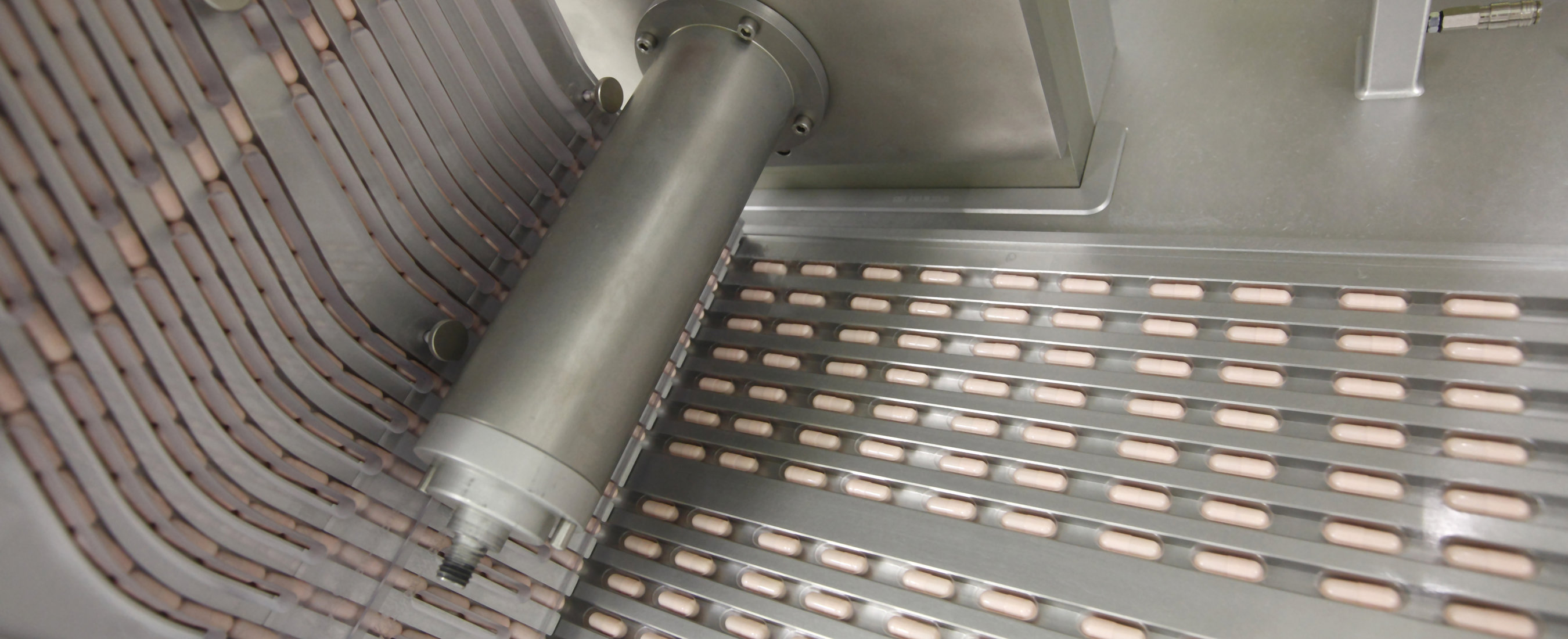

Krka’s vertically integrated business model – which has demonstrated itself as resilient and agile in complex market situations – remains at the core of our strategy. Our mission is to develop and manufacture advanced generic medicines, which are used to treat 50 million people in more than 70 countries around the world every day. With a focus on small molecules, we are constantly increasing our range of products with innovative fixed-dose combinations and entering new therapeutic areas. We intend to facilitate sales growth with both current and new products. All Krka Group processes are designed to ensure long-term profitability that is necessary for further development of the company. We plan to allocate 10% of revenue to research and development.

Also in the upcoming five years, we intend to focus on digitalisation aimed at Shop Order (SO) automation and optimisation of processes, strengthening cooperation within the company and in the entire supply chain from development, production, quality management, marketing to sales and supporting functions, and ensuring relevant data and information for making business decisions.

We intend to upgrade the Krka Group’s sustainability culture, integrate sustainability aspects in corporate governance and business decisions, and maintain accountability in terms of economics, society, and nature in all environments where we operate. We endeavour to upgrade Krka’s sustainability culture by additional disclosures in accordance with the GRI standards, and to obtain the ESG rating in 2023.

DEVELOPMENT STRATEGY IS BASED ON THE MISSION, VISION AND VALUES OF THE KRKA GROUP.

All Krka Group processes are designed to ensure long-term profitability that is necessary for further development of the company.

Key Strategic Guidelines

up to 2026

Markets

We plan to strengthen our position as one of the five leading generic pharmaceutical companies in all our traditional markets of Slovenia, eastern, central and south-western Europe. This involves strengthening our sales and market shares, in particular in therapeutic categories and molecules with already strong Krka presence (medicines for the treatment of cardiovascular diseases, the central nervous system, gastrointestinal disorders, and pain relief), and in categories with high growth potential (diabetes). We intend to strengthen our position as one of the top ten generic pharmaceutical companies in all western European markets.

Thanks to our broad product portfolio and an extensive marketing-and-sales network in our traditional markets we have been known to provide high-quality products, and our company brand has been recognised as a safe and stable provider of medicines. As our marketing-and-sales network in key markets performs successfully, we achieve even higher growth than the market itself.

We were recognised as a domestic manufacturer in four key markets where Krka has established its manufacturing facilities. This gives us an important competitive advantage, particularly in the Russian Federation, where we are increasing our production capacities.

In Overseas Markets we plan to market our products under our own brands through a partnership network established with unrelated parties and through our own companies. In China, we intend to further pursue product registration and sales activities, and winning tenders by being present in the market.

Products

We plan to ensure that new and vertically integrated products account for the largest possible proportion in total sales in addition to the existing range of products, also referred to as ‘the golden standard’.

As an innovative generic company, we aim to enter new therapeutic classes and specialities and develop complex products, including biosimilars.

We plan to strengthen the position of products in our key therapeutic categories: medicines for the treatment of cardiovascular diseases, the central nervous system, gastrointestinal disorders, and pain relief.

We intend to add new pharmaceuticals to our antiaggregant, anticoagulant, and oncology product groups.

We plan to obtain marketing authorisations for products from our pain relief range in all our key markets.

We plan to add parenteral dosage forms to the group of antidiabetic agents and hence introduce advanced technologies of complex peptide molecules.

We intend to increase our non-prescription product range, which is not prone to seasonal changes, and extend the product range in complement with our prescription pharmaceuticals. In animal health, we aim to focus on companion animal products, the most promising animal health product class.

Key strategic objectives

up to 2026

Krka’s key strategic goals are based on the five-year Development Strategy.

Attain at least 5% average annual sales growth in terms of volume/value, achieve above-average sales growth against market dynamics, and remain or rank among the leading generic pharmaceutical companies with our brands in individual markets and selected therapeutic categories.

To strengthen and optimise the vertically integrated business model, proven to be an effective strategic guideline and a comparative advantage. To ensure high standards of product quality, safety and efficacy.

To keep the focus on the long-term profitability of the products sold, all from development and production to marketing and sales, including all other functions within the Krka Group, and to achieve an average EBITDA margin of at least 25%.

To ensure that new products and vertically integrated products account for the largest possible proportion in total sales in addition to the existing range of products, also referred to as ‘the golden standard’. To enter new therapeutic categories and specialities as an innovative generic pharmaceutical company, and develop complex products, including biosimilars.

To ensure growth through long-term business partnerships and targeted acquisitions in addition to organic growth. The primary goal is to increase sales by entering new markets and launching new products.

To allocate 10% of revenue to research and development, and approximately the amortisation and depreciation cost, i.e. €110 million annually on average, to investments.

To pursue a stable dividend policy while considering the Group’s financial requirements for investments and acquisitions when determining the proportion of net profit to be paid out as dividends each year, and allocate at least 50% of net profit attributable to majority equity holders of the controlling company for dividends.

To upgrade the Krka Group culture of sustainability, integrate sustainability aspects into corporate governance and business decisions, and maintain our economic, social and environmental responsibility to the environments in which we operate. To disclose sustainability topics in accordance with the GRI standards in 2022 and obtain an ESG rating in 2023. Summary of strategic ESG goals

To exploit digitalisation potentials in all business phases.

To maintain independence.