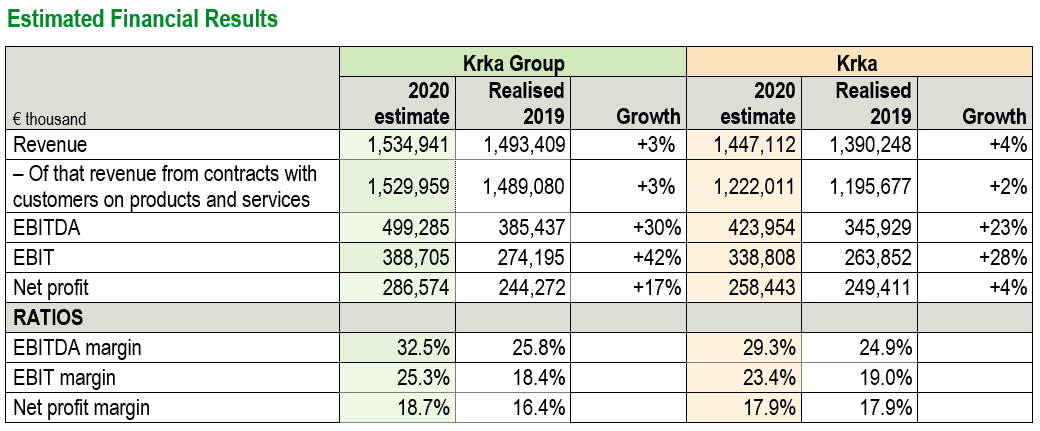

The Management Board of Krka, d. d. held a press conference today and presented the 2020 unaudited preliminary results of the Krka Group and the controlling company Krka, which the Supervisory Board discussed at their meeting yesterday. In 2020, the Krka Group generated €1,534.9 million revenue, up 3% on 2019. Based on unaudited financial statement estimates, net profit of the Krka Group is expected at €286.6 million, up 17% compared to 2019. Publication of the 2020 unaudited financial statements of the Krka Group and Krka is scheduled for Thursday, 18 March 2021.

The President of the Management Board and Chief Executive Jože Colarič explained: “In 2020, the COVID-19 pandemic put the world to a test. At Krka, we reacted quickly to the new situation. We protected our employees, ensured uninterrupted operations, and provided for ample supplies of quality and efficacious pharmaceutical products in markets at all times. We proved that, thanks to our vertically integrated business model, we are flexible and ready to react in an instant to ever changing and challenging situations.

Even though the pandemic hindered our marketing-and-sales activities, we recorded best sales results ever. Our product and service sales amounted to €1,530 million, the highest since incorporation. We obtained marketing authorisations for 20 new medicinal products, including the first one in China. Increased sales and business process efficiency resulted in improved margins and the highest net profit so far, estimated at over €286 million.

The Supervisory Board appointed me the President of the Management Board and CEO of Krka, d. d., Novo mesto for the 2022 to 2027 term and gave me the mandate to form the new Management Board for the term. The appointment of other Management Board members is planned for the regular meeting of the Supervisory Board on 17 November 2021. Based on the expressed trust, my colleagues and I will continue to pursue the set company goals together. In the second half of the year, we intend to review the five-year strategy and upgrade the goals. During the new mandate, we will lead Krka by following the course of an internationally established and innovative generic pharmaceutical company that implements the set financial and sustainability goals to benefit all stakeholders.”

Last year, the Krka Group’s overall investment in expansion of capacities and research and development added up to just shy of €230 million.

In 2020, the Krka Group increased revenue and improved profitability. Year on year, EBITDA increased by 30%, while EBITDA margin reached 32.5%.

Sales

In 2020, the Krka Group generated €1,534.9 million revenue, of which revenue from contracts with customers on sales of products and services amounted to €1,530 million. Revenue from contracts with customers on sales of materials and other sales revenue constituted the difference. Revenue increased by €41.5 million or 3% compared to the previous year.

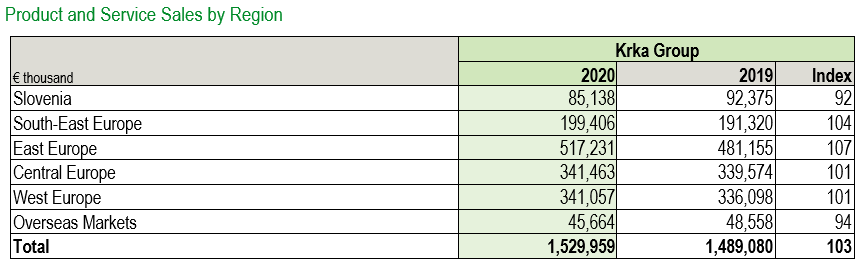

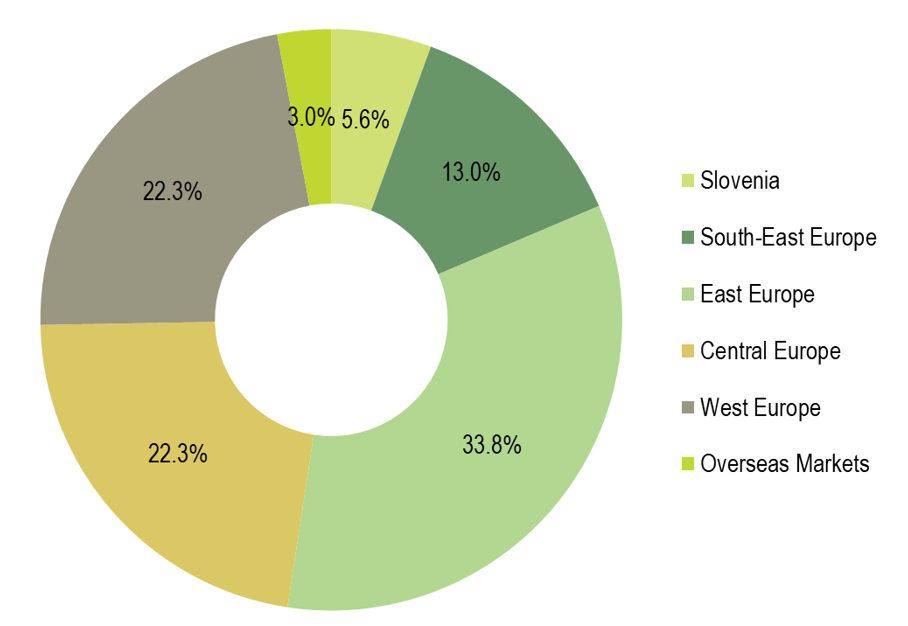

Region East Europe generated €517.2 million, accounting for 33.8% of total Krka Group’s sales total and was the largest region in terms of sales. Sales increased by 7% year on year. In the Russian Federation, we made €326.9 million by product sales, a 5% rise compared to 2019. Growth denominated in the Russian rouble totalled 17%. In Ukraine, product sales amounted to €86 million, resulting in 8% growth. We also recorded growth in all other regional markets, except in Mongolia.

Region Central Europe, comprising the Visegrad Group and the Baltic states, followed with €341.5 million or 22.3% of total Krka Group sales. We recorded 1% growth compared to the year before. Poland, the leading market, generated €163 million in product sales and recorded 2% growth. Sales growth denominated in the złoty reached 5%. Sales also grew in Latvia and Estonia.

Region West Europe made €341.1 million, accounting for a 22.3% share, and was the third largest Krka Group region in terms of sales. We recorded a 1% increase compared to the year before. Germany generated the strongest sales, reaching €90.9 million (up 6%). It was followed by the Scandinavian countries, France, Spain, and Italy. Growth was the highest in Benelux, France, Austria, Italy, Portugal, and Germany.

Product sales in Region South-East Europe amounted to €199.4 million, 4% more than in 2019, and constituted 13% of total Krka Group sales. Romania, which generated sales of €58.1 million, and Croatia were our two leading markets in the region. We recorded the highest sales growth rates in small regional markets of Albania, Montenegro, and Kosovo, and in large regional markets of North Macedonia, Bulgaria, and Serbia.

In Slovenia, sales reached €85.1 million, accounting for 5.6% of total Krka Group sales. The overall sales decreased by 8%. Products recording 5% growth constituted the major part of sales totalling €55.4 million. Sales of health resorts and tourist services totalled €29.8 million, a decrease of 25% compared to 2019. Lower sales resulted from the introduced restrictions for curbing the COVID-19 pandemic.

Region Overseas Markets accounted for a 3% share of total Krka Group sales and generated product sales worth €45.7 million, a 6% year-on-year decrease.

- East Europe 11%;

- South-East Europe 5%;

- Slovenia 2%;

- West Europe 1%; and

- Central Europe 1%.

Among ten largest individual markets, sales of prescription pharmaceuticals saw the highest growth in relative terms in Ukraine, the Russian Federation, and Germany, and among other markets in France, Benelux, and Belarus. Also in 2020, top-ranking therapeutic classes of prescription pharmaceuticals included medicines for the treatment of cardiovascular diseases, the central nervous system, and gastrointestinal tract.

Ten leading prescription pharmaceuticals in terms of sales were product groups containing:

- valsartan (Valsacor, Valsacombi, Vamloset, Co-Vamloset, Valarox);

- perindopril (Prenessa, Co-Prenessa, Amlessa, Co-Amlessa, Roxiper, Roxampex);

- losartan (Lorista, Lorista H, Lorista HD, Tenloris);

- atorvastatin (Atoris);

- pantoprazole (Nolpaza);

- rosuvastatin (Roswera, Co-Roswera);

- esomeprazole (Emanera);

- enalapril (Enap, Enap H, Enap HL, Elernap);

- candesartan (Karbis, Karbicombi, Kandoset); and

- tramadol (Doreta, Tadol).

All pharmaceuticals listed above are marketed under different brand names in individual countries.

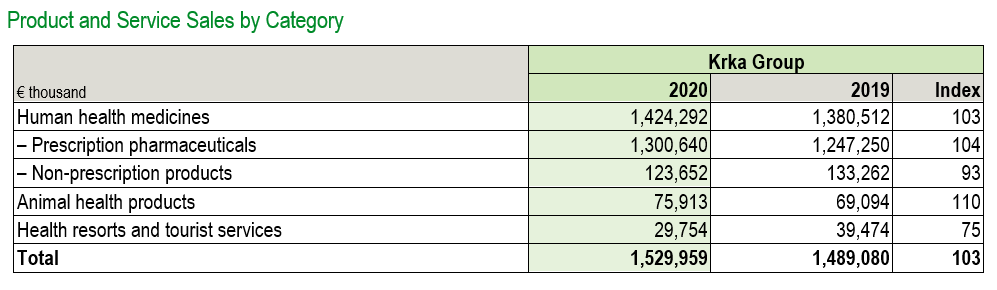

Sales of non-prescription products totalled €123.7 million, a 7% year-on-year decrease, and accounted for 8.1% of total sales. Sales of animal health products grew by 10% and amounted to €75.9 million (5% of total sales). Sales of health resort and tourist services totalled €29.8 million, down 25% compared to 2019 (1.9% share of total sales).

Research and Development

According to our estimates, we invested €151.8 million in research and development last year, or 9.9% of total sales revenue, which is in line with our strategy. Pursuant to strategic guidelines, up to 10% of total sales revenue should be allocated for research and development annually. We employ approximately 700 experts in the field and have more than 170 products in the development pipeline.

We were granted marketing authorisations for 20 new products (16 prescription pharmaceuticals, two non-prescription products, and two animal health products). We concluded more than 200 various registration procedures, granting us marketing authorisations for new products and the established ones for sale in new markets.

In 2020, we filed eight patent applications for technological solutions we had developed and evaluated as inventions. We submitted one regional and six international patent applications based on priority applications from 2019. We were granted eight patents in several countries. More than 200 patents filed by Krka are currently in force.

We filed 55 applications for Krka trademarks in Slovenia and 41 international and 51 national trademark applications. All in all, we have registered more than 1,100 trademarks in several countries.

An important achievement in 2020 was the first marketing authorisation granted to us in China for our antiepileptic, pregabalin hard capsules. We received marketing authorisations for two strengths with the same indications as the originator for the treatment of postherpetic neuralgia and fibromyalgia.

We received marketing authorisations for medicinal products containing our new active ingredients:

- Xerdoxo, Rivarolto (rivaroxaban) film-coated tablets in four strengths, the first oral direct thrombin inhibitor indicated for prevention of atherothrombotic events in adults with various cardiovascular diseases;

- Ticabril, Atixarso (ticagrelor) film-coated tablets, a reversible platelet aggregation inhibitor for patients with acute coronary syndrome, which reduces risk of cardiovascular events, i.e. myocardial infarction and stroke;

- Erlotinib Krka (erlotinib) film-coated tablets in three strengths indicated for the treatment of patients with metastatic non-small cell lung cancer and in combination with another medication also for the treatment of pancreatic cancer;

- Lenalidomide Krka (lenalidomide) hard capsules indicated for the treatment of various types of blood cancer as monotherapy or in combination with other medicinal products;

- Anastrozole Krka (anastrozole) film-coated tablets indicated for the treatment of various types of breast cancer;

- Efigalo, Fingod (fingolimod) hard capsules used to treat multiple sclerosis;

- Lacosabil, Lydraso (lacosamide) film-coated tablets in four strengths used for the treatment of epilepsy;

- Hydroxychloroquine sulfate Krka (hydroxychloroquine) film-coated tablets.

We obtained marketing authorisations for Olsitri (olmesartan/amlodipine/hydrochlorothiazide) film-coated tablets in five strengths, our new single-pill cardiovascular agent, and an antidiabetic Maymetsi (sitagliptin/metformin) film-coated tablets.

We received marketing authorisations for new pharmaceutical forms of: Dekenor, Dexfenia, Dexketia (dexketoprofen) film-coated tablets – this established product is indicated for symptomatic treatment of mild to moderate pain; and Algominal (metamizole) film-coated tablets (a new pharmaceutical form) used to relieve severe pain.

Doreta SR (tramadol/paracetamol) prolonged-release tablets indicated for the treatment of moderate to severe pain had been proven safe, so we obtained marketing authorisations again.

We received new CEPs for our active ingredients rabeprazole for the treatment of stomach problems and

a cardiovascular agent rosuvastatin, and were granted marketing authorisations.

Our non-prescription range was extended by a new formulation of our B-Complex film-coated tablets indicated for prevention and treatment of hypovitaminosis B, avitaminosis B, increased body demand, malabsorption, and various other severe forms of vitamin B deficiency. A new pharmaceutical form of Flebaven 1 000 (diosmin/hesperidin) was approved in the Russian Federation. It is indicated for the treatment of symptoms of chronic venous insufficiency in adults and an acute attack of haemorrhoidal disease in adults.

We added two new products for farm animals to our animal health range. Tuloxxin, Tulaxa (tulathromycin) 25 mg/ml solution for injection in three different bottle volumes is an advanced antimicrobial used to treat bacterial infections of the respiratory tract in pigs. FlorFlu, Flovuxin (florfenicol/flunixin) solution for injection is available in two different bottle volumes and is to be administered by a single injection. It has antimicrobial, analgesic, and anti-inflammatory effect and is indicated for the treatment of respiratory infections in cattle.

We adopted the new product registration legislation that entered into force in the Eurasian Economic Union (EAEU) and obtained marketing authorisations under this procedure for two our products for the first time.

We continuously upgrade, improve, and bring our established products in line with the latest trends and requirements. We file marketing authorisation applications with regulatory authorities as regulatory variations for our revised products. In order to optimise products, we applied for more than 30,000 variations in 2020.

We obtained new marketing authorisations for the established products from all our product groups in more than 60 countries from all our regions.

Investments

The estimated value of investments made in 2020 reached just short of €78 million, €61 million in the controlling company. We primarily invested in development capacities, manufacturing upgrades, quality management, and our own production-and-distribution centres across the world. In this period, our investments lagged behind the plan due to the COVID-19 pandemic impact on the construction industry, but this has no impact on the realisation of the related strategic guidelines.

We built a multipurpose warehouse at our central site in Ločna, Novo mesto, to provide for extra storage room for incoming materials and finished products. This improved production flexibility, product availability, and market supply. At the beginning of 2020, JAZMP (Agency for Medicinal Products and Medical Devices of the Republic of Slovenia) granted us an operating permit, so all requirements for the facility start-up were met. By the end of August 2020, we built and equipped an extension in the raw-material warehouse for a two-way flow between the multipurpose warehouse, warehouse for raw materials, and weighing rooms. We apportioned €34.6 million to the investment.

Notol 2, the state-of-the-art facility for manufacturing solid dosage forms, is also in Ločna, Novo mesto. The growing need for extra production capacities has incited us to acquire additional technological equipment. We started equipping a new packaging facility in 2019 and continue setting it up also this year. The investment was estimated at €41 million. In 2020, we allocated €17 million for this project. When the Notol 2 plant is technologically equipped, we will be able to manufacture 5 billion and package 8 billion tablets per year.

In Krško, we constructed a new warehouse for raw materials used in chemical and pharmaceutical production. In July, we obtained an operating permit and in September also JAZMP’s operating permit for the plant. The investment was estimated at €8.2 million. We plan to build new capacities for development and production of active ingredients at the same site.

The high-capacity packaging line purchased for the Ljutomer production plant will allow for expanded packaging output of lozenges and tablets. The warehousing section of the plant was refurbished into a temporary storage room in compliance with the standards of good warehousing practice and health and safety at work. We apportioned €5.7 million to the project.

We have been making low investments into refurbishment of Notol (the solid dosage form production facility), the OTO solid dosage form production plant, and the Beta Department. In 2020, €5.1 million was invested in renewal of systems and devices.

The Krka-Rus plant in the industrial zone of Istra in the north-western part of Moscow is one of the key investments in Krka subsidiaries abroad. The plant manufactures more than 80% of products intended for the Russian market giving us the status of a domestic producer in the Russian Federation. In the next few years, we plan to increase production and laboratory capacities. The investment was estimated at €35 million. In 2020, we allocated €5 million for this project.

Last year, we continued making purchases of the manufacturing and quality control equipment for production rooms taken on lease for our joint venture Ningbo Krka Menovo in China. The plant manufactures products for markets outside China and since January 2021 also the first product intended for the Chinese market.

Employees

At the end of 2020, the Krka Group employed 11,677 people, of whom 5,418 worked abroad and constituted a good 46% of the total Krka Group headcount. The proportion of Krka Group employees with at least university-level qualifications was 51%, and 206 employees held doctoral degrees. Together with agency workers, the Krka Group employed 12,631 people.

Share and Investor Information

In 2020, the price of Krka share on the Ljubljana Stock Exchange increased by 25%, reaching €91.40 at the end of the year. Market capitalisation of Krka amounted to €3 billion.

At the end of the year, Krka had a total of 47,369 shareholders. The shareholding structure, with 38.2% of domestic retail investors (natural persons) and 23.2% of foreign investors, is stable and without any major changes.

In 2020, the company allocated short of €26 million to treasury share repurchase programme and €133 million for dividends. The company acquired 307,522 treasury shares and as at 31 December 2020 held a total of 1,541,774 treasury shares, accounting for 4.701% of share capital.

The Management and Supervisory Boards updated the Corporate Governance Policy in accordance with the Corporate Governance Code. The document summarises provisions of the Articles of Association, rules of procedure, and internal acts that specify functioning of the governing and supervisory bodies and corporate governance, in particular information relevant for shareholders. For the first time, the Management and Supervisory Boards adopted the diversity policy in line with the recommendations of good practice, in particular of the Slovenian Directors’ Association. The policies are available at the corporate public website www.krka.biz, tab For Investors, section Corporate governance documents.

Coping with COVID-19

Krka is a pharmaceutical company, so our processes are strictly regulated and standardised. At the outbreak of COVID-19, we adopted a wide range of additional actions to comply with preventive, legal, and labour measures advised by healthcare professionals, especially preventive hand sanitation, mask-wearing, social distancing, regular room airing, etc. At entrances to our premises, every person, whether a Krka employee or a contractor, must have body temperature taken, disinfect hands, and put on a protective mask. We carry out additional procedures for disinfection of rooms, materials, vehicles, and work places.

Whenever possible, meetings, training courses, and other similar activities are arranged using digital tools. We timely detect any infections in asymptomatic persons by antigen testing for SARS-CoV-2. Organisation of working processes has been adjusted and flextime introduced to help employees manage their work and family duties.

Krka provides for a safe and healthy work environment thanks to all measures that prevent spreading the infection.

Last year, we recorded no increase in sick leaves, which accounted for 6.4% and was comparable to the 2019 figure of 6.6%. Of that, 0.4 percentage points of total 2020 sick leaves was recorded due to COVID‑19. All data taken into account, we can say a certain degree of absence was recorded as a result of COVID-19. However, absence due to other illnesses declined because of strict preventive measures taken to curb the pandemic.

2021 Krka Group Plans

According to the 2021 plan, the Krka Group sales of product and services are projected at €1.535 million and net profit at approximately €265 million. We intend to allocate €114 million for investment projects to increase and upgrade production capacities and the infrastructure. The total number of employees in Slovenia and abroad is projected to grow by a good one per cent. The total number of regular employees is projected to reach 12,140 by the end of 2021.

The 2021 business plan derives from the 2020–2024 Krka Group Development Strategy and is based on estimates, assessments, projections, and other available data. The Management Board believe the projections are reasonable. The 2021 sales plan guarantees that, in the period from 2017 to 2021, the average annual sales growth will be higher than the 5% average annual growth specified in the strategy.

The 2021 business results will also depend on spreading of the COVID-19, the related restrictions imposed by the states, and global recovery after the pandemic. These events and processes are highly unpredictable and can result in lower regional or global economic growth than planned, increased unemployment rates, further depreciation of certain currencies, and a decrease in demand for pharmaceutical products. Of course, the processes can turn positive as well.

Authority to Compose the Management Board

On 31 December 2021, the six-year term in office expires to the members of the Management Board. At yesterday’s meeting, the Subsidiary Board appointed the current President of the Management Board and CEO Jože Colarič for another six-year term, commencing on 1 January 2022. They gave him the authority to draw up a proposal for appointing other members to the Management Board by November 2021 at the latest.